alameda county property tax due dates

Email SMSText Message. Use in the conduct of official Alameda County business means.

Alameda County On Twitter Deadline For 2nd Installment Of Secured Property Tax Payments Is Friday 4 10 20 Pay By Phone Online With E Check Credit Card Or Mail A Check We Will Honor Postmark Date

The business hours are from 830 am to 500 pm weekdays.

. Subscribe to avoid late fees. In addition to counties and districts such as schools many special districts such as. The valuation factors calculated by the State Board of Equalization and.

1221 Oak Street Room 131 Oakland CA 94612. 1 and is delinquent at 5 pm. Many vessel owners will see an increase in their 2022 property tax valuations.

Dear Alameda County Residents. Second installment real property taxes due and payable. Not only for Alameda County and cities but down to special-purpose districts as well such as sewage treatment plants and athletic parks with all reliant on the real property tax.

Time to read. Pay Supplemental Property Tax. The tax type should appear in the upper left corner of your bill.

Pay Secured Property Tax. Office hours location and directions. If ordered by board of supervisors second installment.

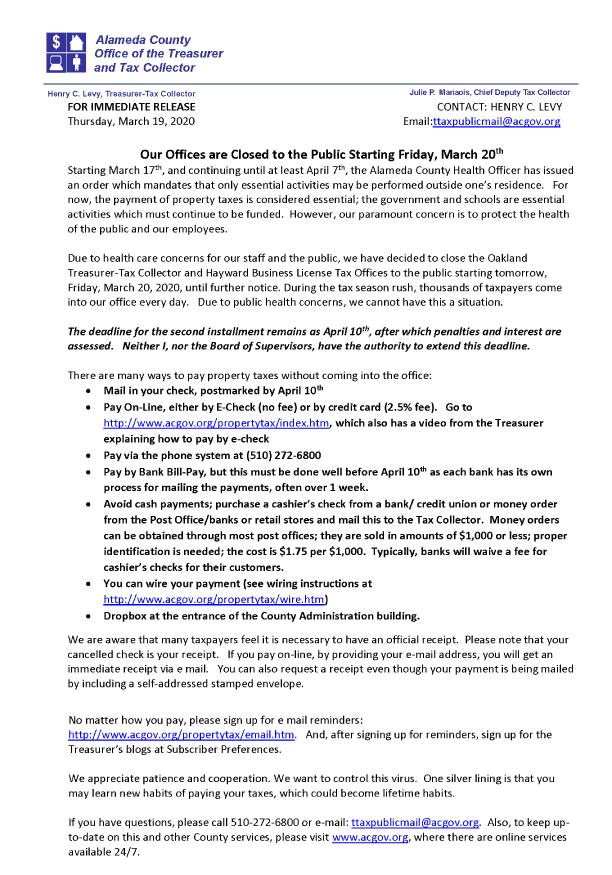

This process will remain in effect until May 4 -- the current expiration date for Alameda Countys shelter order -- and new policies will be announced in the future according. The Treasurer-Tax Collector TTC does not conduct in-person. Legal deadline for filing business personal property statements without penalty.

If May 7 falls on a Saturday Sunday or legal holiday a property statement that is mailed and. 10 after which a 10 percent delinquent penalty will be. This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200.

2700 and 2702 Rev. Available mid October through June. Marin County collects the highest property tax in California.

Subscribe with your email address to receive e-mail alerts about important property tax dates. Homeowners can also pay in two installments. The first installment is due Nov.

The deadline to submit property tax payments without penalty remains April 10 a seemingly reluctant Alameda County Treasurer-Tax. Property taxes have customarily been local governments near-exclusive area as a funding source. The due date for property tax payments is found on the coupon s attached to the bottom of the bill.

The following information and services can be accessed with any touch-tone telephone 24-hours a day seven days a week by calling 510 272-6800. You can use the California property tax map to the left to compare Alameda Countys property tax to other counties in California. The system may be temporarily unavailable due to system maintenance and nightly processing.

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Alameda Property Taxes Due Nov 1 In Alameda County Alameda Ca Patch

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Large 1906 Tax Receipt From Oakland Alameda County For Kelsey Tract Ebay

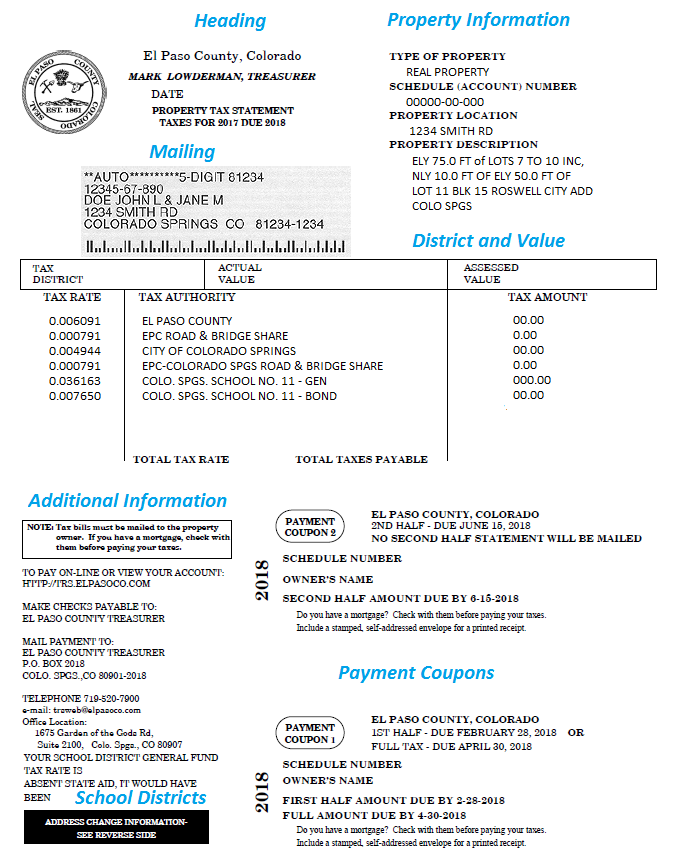

Property Tax Statement Explanation El Paso County Treasurer

Property Tax Payment History Treasurer And Tax Collector

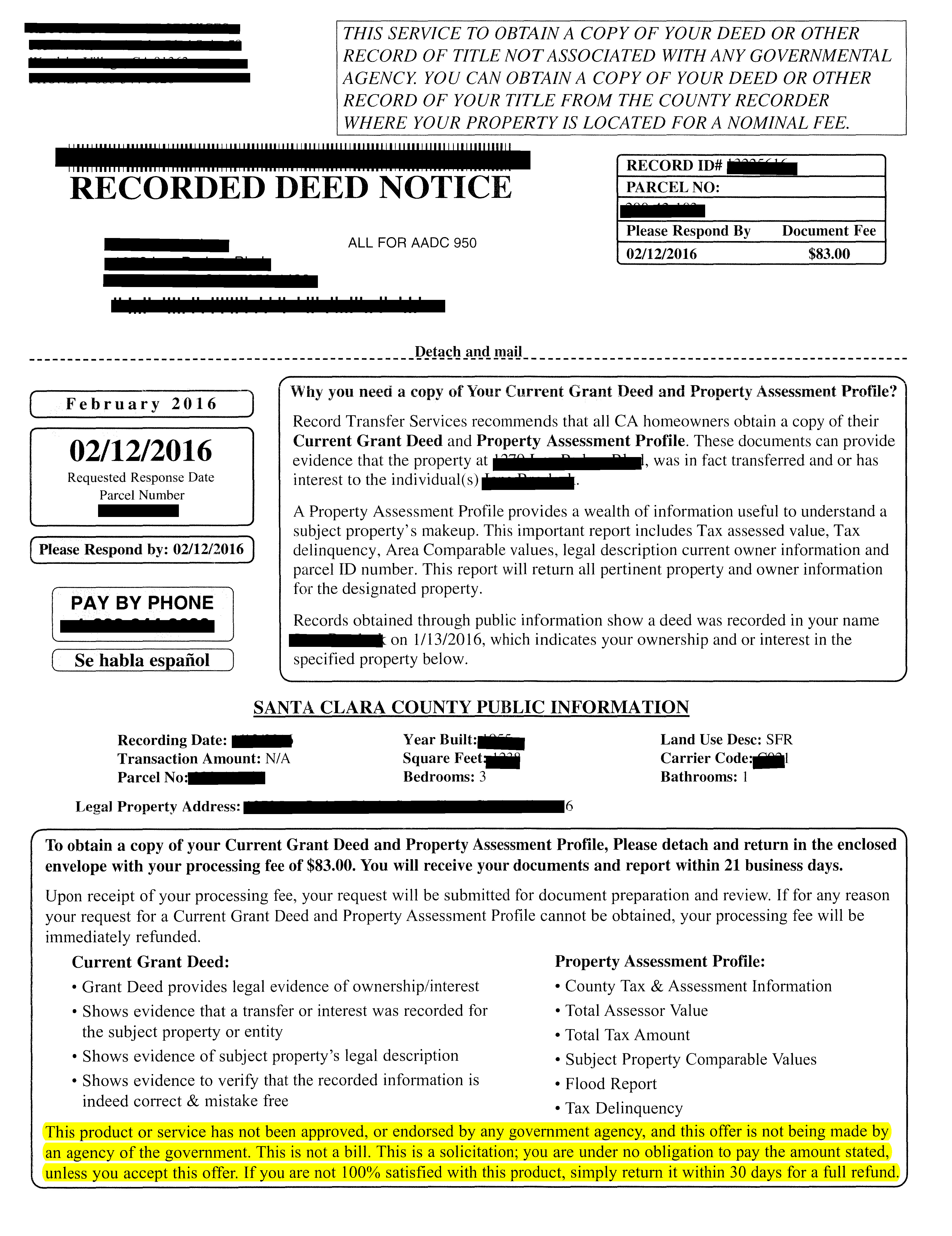

Have You Received A Recorded Deed Notice Mailer Litherland Kennedy Associates Apc Attorneys At Law

David Haubert Davehaubert Twitter

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Tax Collector Announces Property Tax Penalty Waiver Procedure News Pleasantonweekly Com

Alameda County Property Tax Assessment Program Tomorrow August 11 2015 The Advance Sheet

I Got Re Elected Thanks Michael Barnes Albany City Council Meeting Comments And More

How To Pay Property Tax Using The Alameda County E Check System Youtube

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Social Services Agency More Time For Taxes The Alameda County Social Services Agency S Volunteer Income Tax Assistance Vita Program Has Been Extended Through May 8 2021 The Irs Recently

Faqs Alameda County Housing Secure

Alameda County Budget Workgroup Forum February 2011

A Message From Alameda County Treasurer Tax Collector Penalty Waivers Youtube